Managing an organization's accounts receivable is one of its most important tasks. It guarantees that the business promptly and physically collects the money it earns on paper. Accountants use a variety of performance indicators to monitor their work and help them respond proactively to possible issues. One such figure is the ratio of bad debt to sales.

It is vital for Leaders to comprehend bad debt prior to computing the ratio. Any amount of money due to a business that it does not anticipate receiving is referred to as bad debt. There are several reasons why payments cannot be collected, including insolvency or nonpayment on the part of the consumer.

The Bad Debt to Sales Ratio is a financial metric used to assess the proportion of a company's sales that are not expected to be collected due to bad debts. It helps in evaluating the effectiveness of a company’s credit policies and the quality of its receivables management. A high ratio may indicate potential issues with credit control, customer creditworthiness, or economic conditions affecting customers' ability to pay.

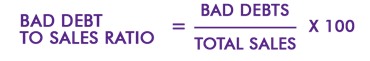

THE BAD DEBT TO SALES RATIO FORMULA:

The formula to calculate the Bad Debt to Sales Ratio is:

The Components of the Formula:

- Bad Debts: The quantum of receivables that the company does not expect to collect. This is usually found on the income statement as an expense.

- Total Sales: The total revenue from sales during a specific period. This is typically found on the income statement.

Example Calculation

Suppose a company has:

Bad Debts of Rs.10,000

Total Sales of Rs. 1,000,000

Using the formula, the Bad Debt to Sales Ratio would be 1%.

This means that 1% of the company’s sales are expected to be uncollectible.

IMPORTANCE AND USE

- Credit Risk Management: It helps in understanding the risk associated with credit sales and the efficiency of the company's credit policies.

- Financial Health Indicator: A lower ratio indicates effective credit control and a higher probability of collecting receivables, while a higher ratio may signal potential cash flow issues.

- Benchmarking: Companies can use this ratio to compare their performance against industry standards or competitors to assess their credit management practices.

STEPS TO IMPROVE THE RATIO

- Tighten Credit Policies: Implement stricter credit evaluations and limit credit sales to high-risk customers.

- Improve Collections: Enhance the collections process to recover receivables more efficiently.

- Monitor Receivables: Regularly review accounts receivable aging reports to identify and address delinquent accounts promptly.

- Customer Creditworthiness: Conduct thorough credit checks and continuously monitor the financial health of customers.

- Automate your Collections Process. Tracking payments, sending reminders, and doing other tasks to enhance collections are made simpler by automation. Additionally, it can save employees time that they would have to spend on laborious tasks like manual ratio calculations.

By keeping an eye on the Bad Debt to Sales Ratio, companies can maintain healthier cash flows and reduce the risk of significant losses due to uncollectible accounts. AR automation tools like Inebura streamlines the invoicing of such customers, helps in tracking the payments as well as AR performance monitoring with systematic and automatic strategy based follow up with debtors.

To know more, write to sandeep@inebura.com